View pictures in App save up to 80% data.

As a result of new regulations governing how automakers must source the materials for their electric car batteries, several models from automakers like Jeep, Rivian, and Ford have lost their eligibility for the $7,500 federal EV tax credit instituted by President Biden's Inflation Reduction Act . Others, like Hyundai, have meanwhile gained eligibility. All told, more vehicles are eligible in 2025 than last year (27 total compared to 22 last year), but some popular models have lost their eligibility.

View pictures in App save up to 80% data.

The immediate elimination of tax credits might significantly impact electric vehicle sales, yet over time, it may prove to be inconsequential.

What Developments Occurred in 2025?

This year, the credit has been divided into two parts. Vehicles can receive half of the $7,500 credit if both the vehicle and its batteries are manufactured in America. The complete amount is available for vehicles whose battery materials are obtained from sources outside of what the U.S. designates as "foreign entities of concern," which include countries like China, Iran, Russia, and North Korea. To qualify, 60% of the battery materials must be extracted or processed in the U.S. or by one of its free-trade partners, with this requirement increasing to 80% by 2027.

There are pricing thresholds that must be met: The maximum sticker price for trucks, SUVs, and vans is set at $80,000, while other vehicle types face a stricter limit of $55,000. This has led to some debate, as it may encourage automakers to focus on producing larger, more material-heavy electric vehicles (EVs) that fall under the higher price category—something that seems counterproductive to the goal of reducing emissions. Nonetheless, the list of vehicles qualifying for 2025 has undergone considerable changes. A larger number of models from Genesis, Hyundai, and Kia are now eligible, including the Ioniq 5, EV9, Genesis Electrified GV70, and the Kia EV6 and EV9.

View pictures in App save up to 80% data.

Include TopSpeed in your Google News updates.

Who Will Be Left Out of Tax Credits in 2025?

Quite a few vehicles also lost access to the credit or saw their eligibility cut. The Volkswagen Group's Audi Q5 and VW ID4 are both out, as are Ford's Corsair and Escape PHEVs and Nissan's Leaf. Rivian, notably, lost out on this year's credits but has said it will regain eligibility soon with its R2 crossover , while the R1S and R1T can still qualify so long as they are leased. Meanwhile, Jeep Wrangler 4xe and Grand Cherokee 4xe variants are given the credit on leases as well. The Cybertruck's base model qualifies, as it just inches in under the $80,000 price cap for trucks.

TopSpeed's Perspective

View pictures in App save up to 80% data.

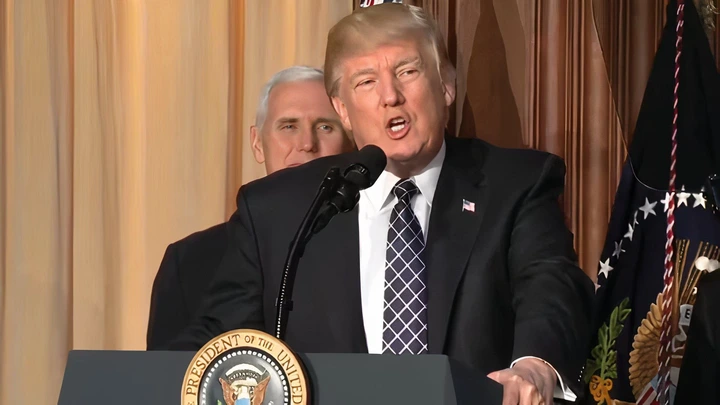

More EVs qualify this year than at any point since the Biden Administration's introduction of the tax credit, but with Biden's defeat in the 2025 presidential election, the future of this incentive is murky. The incoming Trump Admin. has already expressed interest in canceling the credit altogether, though the politicking of some automakers could mean the administration is willing to hear out alternatives.